Six open banking strategy blueprints

Learn why open banking has become a topic of strategic interest from banks, and explore six different open banking strategy blueprints.

Since open banking has moved away from the area of “check-the-box compliance” and into the area of innovative opportunities, it has also become a topic of strategic interest.

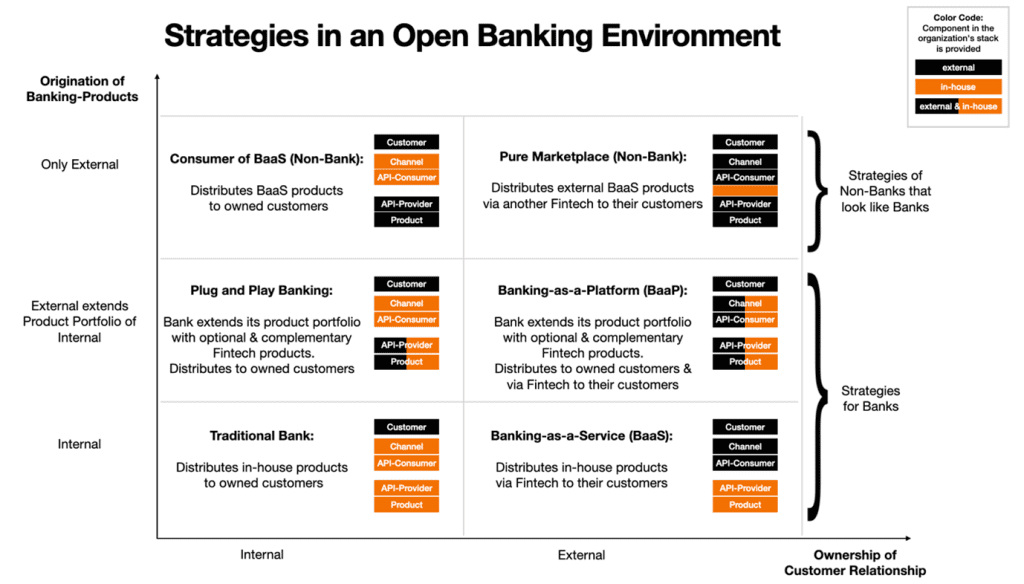

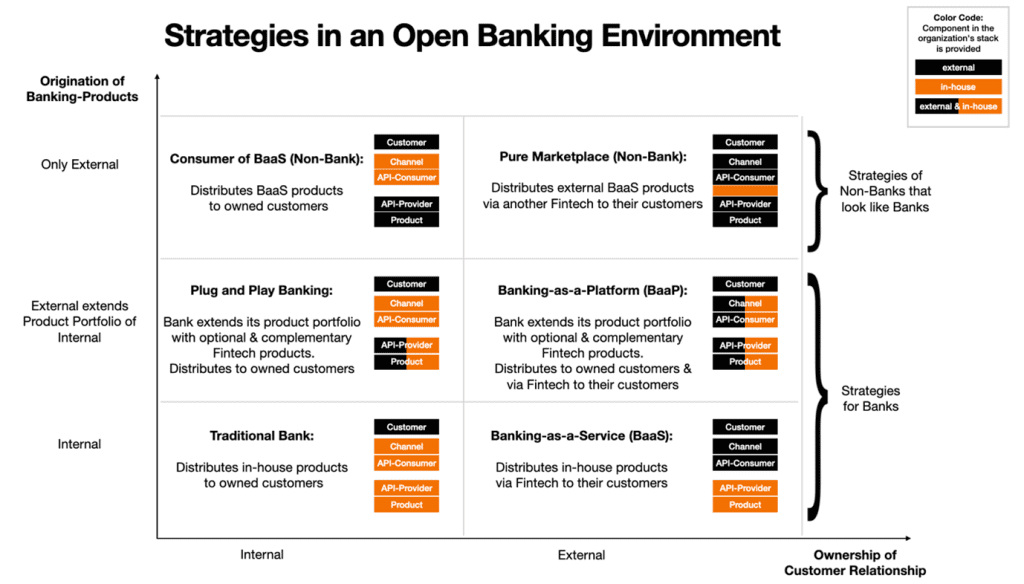

In this blog, I look at open banking from the bank’s perspective. Here I will explore six different open banking strategy blueprints, along two dimensions: (1) ownership of the customer interface (internal/external) and (2) origination of banking products (internal/external/mix).

As open banking becomes a reality in many countries around the globe, the advantages for bank clients are clear: more choice on digital banking offers, personal financial management, multi banking or faster loan and mortgage approvals. Technically, open banking is based on API technology and allows clients to ask their bank to share their financial data conveniently, safely and securely with fintech companies.

In the past, the open banking strategy of banks has been focused on regulatory compliance to avoid fines for non-compliance, pre-empting pending regulation and avoiding the threats of open banking competition.

Digital transformation and open banking

Now, banks are increasingly starting to embrace the opportunities of open banking. There are many reasons for this change in perspective, ranging from the push in digital transformation provided by the Covid-19 pandemic, changed client needs and expectations of seamless and convenient digital experiences, and the many successful applications of open banking by pioneering banks.

Since open banking has moved away from the area of compliance and into the area of innovative opportunities, it has also become a topic of strategic interest.

Open banking encourages competition and provides a mixture of challenges and opportunities for incumbents. Banks that can translate the opportunity of open banking into a clear strategy will be in the best position to start realizing its benefits.

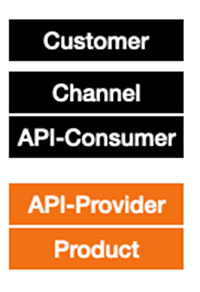

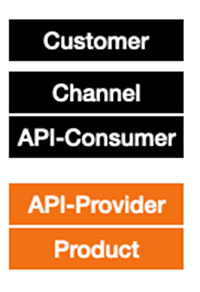

Here are some reflections on how to get there. As a basis for the strategies, we use a simple model of the typical banking stack (introduced in a previous blog) with the three layers of products, channels and customers. Products are things like as loans, accounts and payments. Channels are the delivery mechanism (such as mobile or web) of these products to the customer. And customers of the bank use the banking products via the channels.

This banking stack can be configured differently, by internalizing or externalizing parts of it. We explore six different open banking strategies, classified along two dimensions that traditionally have had a high importance to banks:

- Ownership of the channel, on the x-axis. The channel, or customer interface, can be either owned internally (by the bank) or owned externally (by a fintech).

- Origination of banking products, on the y-axis. The banking products can be provided internally (by the bank), externally (by a fintech), or it is a mix where external fintech products extend the internally available product portfolio.

As a result, we get a 2×3 matrix of strategy options for open banking, as shown in the figure below.

In the traditional model, banks own the digital value chain and the customer interface. There are two options:

(A) If banks stick to their existing digital channels and don’t innovate, they might send customers into the arms of digital banks, neo banks or a big tech banking offer.

(B) If banks develop several new digital offerings themselves to satisfy increased customer demands and expectations, costs may be skyrocketing, innovation risks may be high, and they still may not be able to fulfill all the digital needs of their customers.

In the plug-and play model, banks extend their product portfolio with optional and complementary fintech products. They keep the customer interface under their control and distribute the mixed product portfolio to their own customers. The model has an attractive trade-off with limited costs for the banks, low risks shouldered by the bank, and it still allows clients to get the digital solutions they want. In the open banking model, those digital products are offered to clients in collaboration with a fintech. Open banking provides a moat for incumbent banks, allowing them to ward off attacks by digital bank, neo bank or a big tech banking offers.

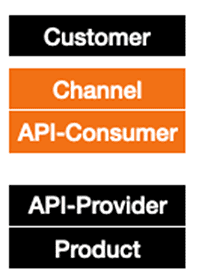

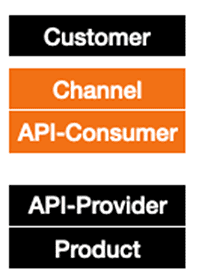

In the banking-as-a-service (BaaS) model, banks distribute their financial products via fintechs and thus have the role of a supplier to the Fintech. The customer relationship to the end-user is not owned by the bank anymore – but by the fintech. This means, that from the end-users’ perspective the bank is (almost) invisible and they only interact with the fintechs. The fintech is the customer of the bank, consuming the bank’s APIs, in order to build innovative customer-facing applications.

With this model, banks can substantially extend their reach, it is an opportunity for tech-savvy banks to become the “Twilio for banking”. Due to cannibalization risk, BaaS is typically not rolled out in the home market, where direct customer relationships need to be protected.

In the banking-as-a-platform (BaaP) model, banks run a multisided platform in addition to providing classic banking services. One side of this platform represents the bank’s regular clients. The other side of the platform is made up of a set of fintechs, which have integrated with the API of the bank. Bank showcases all its fintech participants and their value proposition on a marketplace. Banks can differentiate by the breadth of their fintech offers.

Bank partially owns the customer experience of the end-user and guides end-user to matching Fintech offers on its platform. That means the bank will strive to strike partnerships around the services that are relevant to its customers while forming close partnerships with fintechs in the industry.

Whereas the four models above were only for banks, the following two models can be applied by banks and fintechs alike.

In the consumer of banking-as-a-service (BaaS) model, the organization (bank or fintech) distributes is an API consumer and uses a banking product offered by another player. Typical consumers of BaaS APIs are non-banks that provide a tailored digital banking experience to a niche market. They get the underlying banking services from an API provider. But even banks can profit from becoming a consumer of BaaS, e.g. to fill a gap in their product portfolio with very low overhead.

In the pure marketplace model, the organization (bank or fintech) is nothing more than a broker of banking products. Think of it as the operator of a shopping mall, instead of the operator of a single shop. It is a thin layer between API consumer and API provider. Marketplaces often don’t provide any products themselves but resell the products of others. They might add value by standardizing the APIs they provide, unify all the various APIs offered in one area, or provide supporting/auxiliary services, such as due diligence of the participants.

Keep in mind, that the strategy models do not need to be applied to the complete product range of a bank but will more likely be applied to single products only, such as loans or mortgages.

Based on the six open banking strategy models, banks can assess the viability of each model in terms of strategic alignment. Certainly, tradeoffs need to be made between what banks aim to gain versus what they are giving away.

The value of customer relationships, trust and security are important factors in an assessment.

Watch my video here to learn more:

Learn more about what Software AG can do to help you realize your open banking strategy, by clicking below.