News

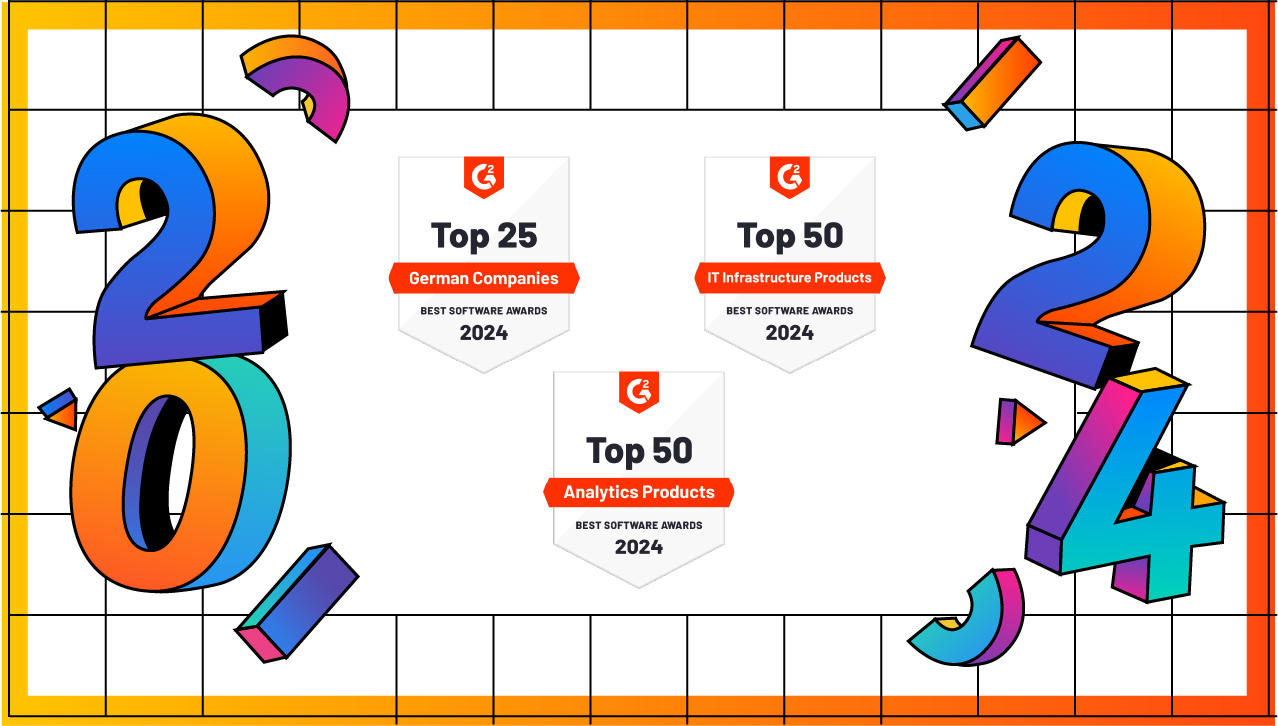

It’s Awards Season, and We’re a 3x Winner on G2’s Best Software for 2024 Awards List

The awards season is upon us. And while we’re as upset as anyone that Barbie’s Greta Gerwig wasn’t nominated for Best Director, we’re focused on the recent G2 announcements. (A G2 award is the “G” in an EGOT, right? Right?) …

Read blog

Latest News posts.

Recent posts

-

News

NewsUnleashing the Power of BotJoy: A Journey of Artistic Awakening and Collective Inspiration

In the rapidly advancing era of Artificial Intelligence and machine-generated content, it's crucial for us to pause and reflect on our humanity. The BotJoy Initiative, showcased at Software AG's International User Group Conference (IUG) in Budapest, offered a transformative experience… -

News

NewsWe look forward to seeing you at Hannover Messe!

Are you an equipment maker and attending Hannover Messe this year? I hope so. Since Hannover Messe opened its doors back in 1947, it has been a must-attend for all equipment manufacturers who are looking for solutions to the challenges… -

News

NewsHow to successfully deploy machine learning models quickly into the hands of operational experts

A common pain point we hear about from our customers is that there is a wide gap between what their data scientists can do and what their operational experts need to know. Data scientist groups are typically charged with looking… -

News

NewsDigital Badging: 10,000 reasons why Software AG offers free, self-paced product & solution enablement

“May you live in interesting times” is an expression that has been overused in the past couple years, but the environment in which enterprise software operates is keeping the saying relevant as 2022 winds down. Since the beginning of the… -

News

NewsTop 5 Takeaways: Gartner IT Symposium/Xpo™ 2022

Software AG's Gartner IT Symposium/Xpo™ 2022 team has returned home from sunny Florida after a busy week that was jam packed with thought-provoking presentations, inspiring conversations, and smiling faces – it was great to be back in person! Whether you… -

App & Data Integration

App & Data IntegrationNew API and Integration benefits in the webMethods 10.15 release

API management is now a crucial aspect of digital transformation that companies need to invest in so that they can use their APIs properly. The way you control how APIs are used at your company – either how the APIs… -

News

NewsReference architectures: Structure and simplicity in the connected world

We often hear questions like these. A short answer is difficult to give, because true connectivity deals with a variety of integration objects: functional integration of applications; curated and consolidating integration of data; composition and mining of business processes; insight-generating… -

News

NewsSustainability at Software AG: Enabling our customers

“In the universe are billions of galaxies. In our galaxy are billions of planets. But there is #OnlyOneEarth.” On the 5th of June, under this banner, the world celebrates World Environment Day. As Senior Vice President Corporate Communications, Sustainability and… -

News

NewsICTs can create accessible, inclusive telecoms for the world

There are still billions of people unconnected to digital telecommunications, including increasingly growing aging populations and people in developing countries. Today, UN World Telecommunication & Information Society Day (WTISD), aims to spread awareness about the social changes caused by the… -

News

NewsThe future of racing is connected

Mario Andretti once said: “If everything seems under control, you're just not going fast enough.” The Electric Racing Academy (ERA) in Zolder, Belgium disagrees. With help from the Internet of Things (IoT) and Software AG, its electric racing cars can…